Put Options (Cash Secured Put)

In this post I won’t go into the details of why I want to own OXY, but suffice to say it’s a stock I’d like to buy and hold long term. As of the time of this writing, OXY is selling for $57.69. Rather than buy 100 shares for that price today for a total of $5,769, I can instead write/sell a contract with an obligation to buy OXY at a set price on a future date.

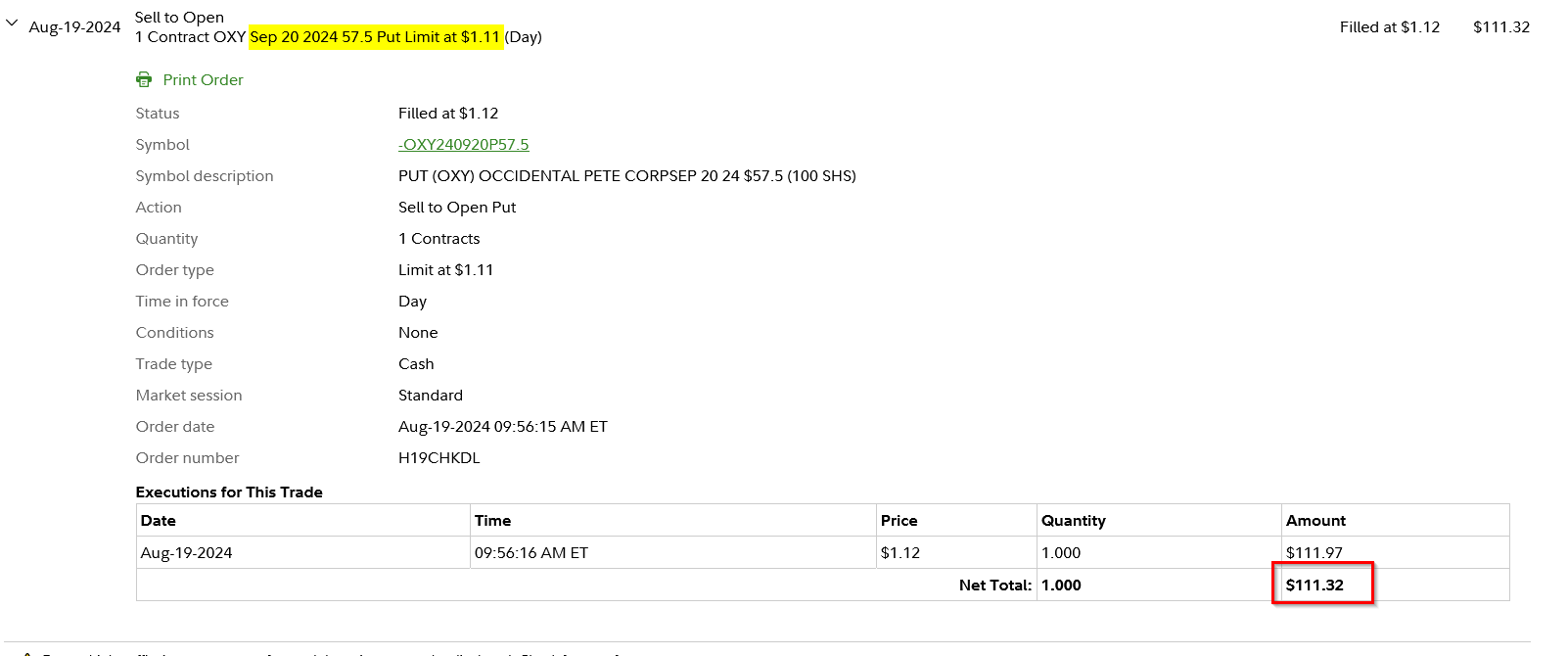

In this first order, I’ve committed to buying 100 shares of OXY at a strike price of $57.50 (slightly lower than the current price) on Sept. 20. For writing this contract, I am paid $111.32 today.

This is known as a Cash Covered Put. I need to have the full $5,750 in my account to pay for the shares in case I am assigned on 9/20.

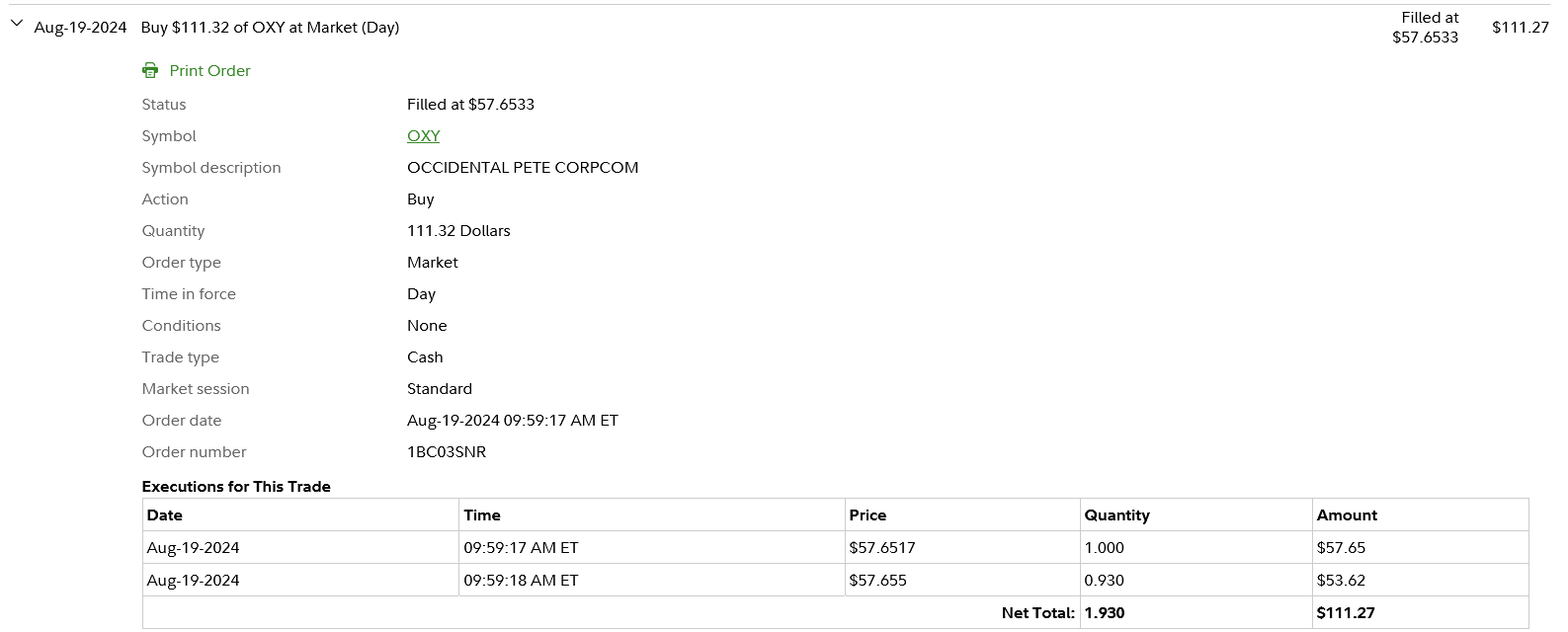

Rather than keep the $111.32 in cash, I prefer to reinvest it back into the same stock, so this is my order to buy more OXY using the proceeds from those premiums.

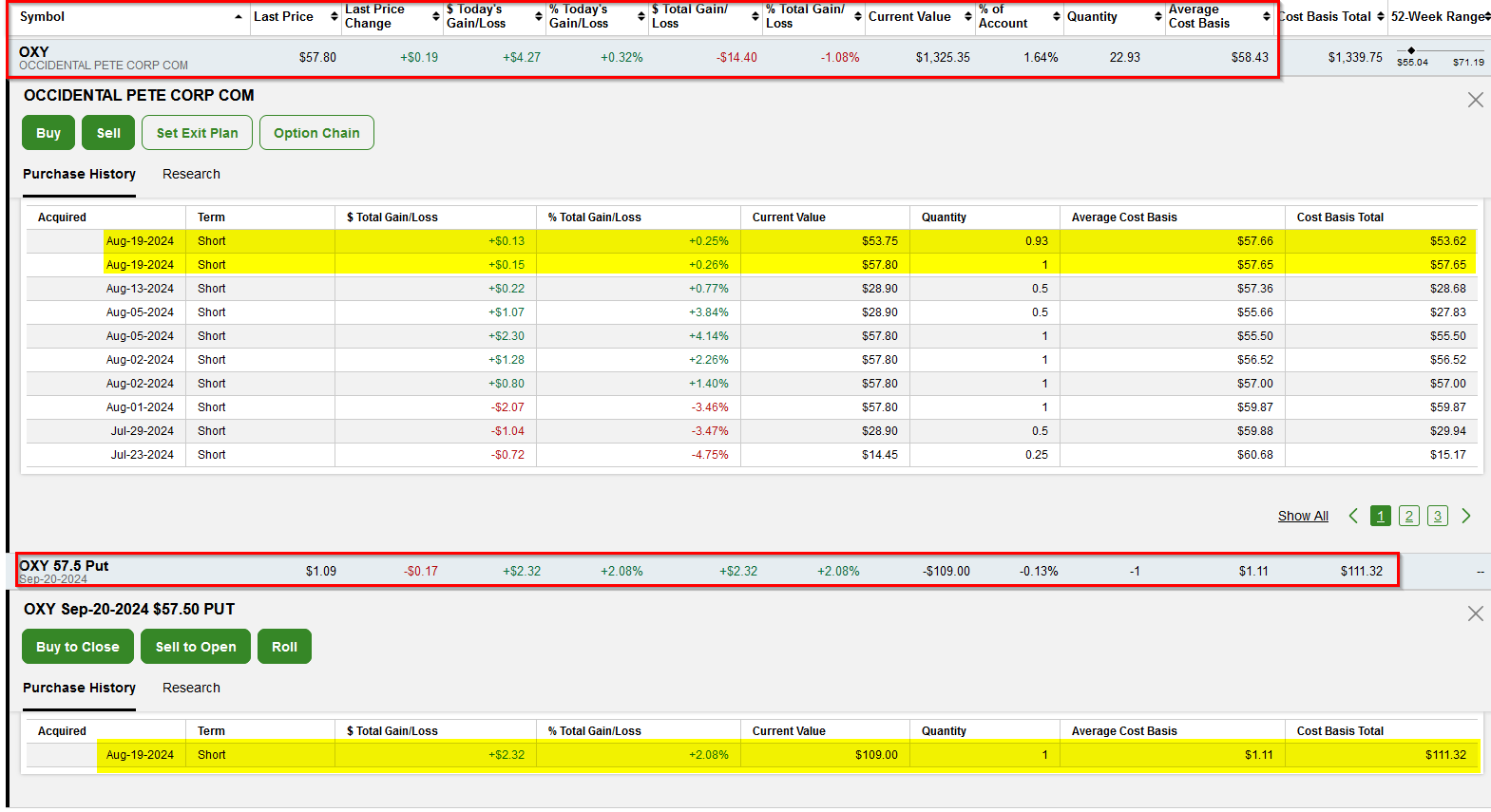

Finally, the positions themselves on my Fidelity page. A put contract is listed as having -1 quantity, since I sold it.

If OXY is below $57.50 on 9/20, I will have to buy 100 shares at that price, regardless of what price it is (this is why you have to be confidident you’re ok with the price). If it’s >57.50, you keep the $111.32 (or extra shares of OXY in my case) and start over.

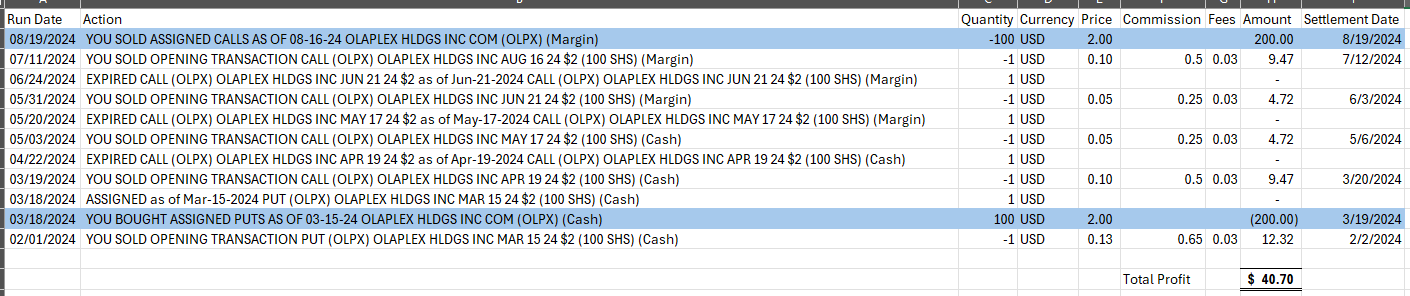

The next screenshot is an example of how selling options can net you profit even if the price does not move on a stock. A put was sold on OLPX, filled at $2, and eventually a $2 call was filled to sell them for the same price. However, $40 in premiums was made along the way, for a 20% increase, or 40% annualized over the 6 months this took.

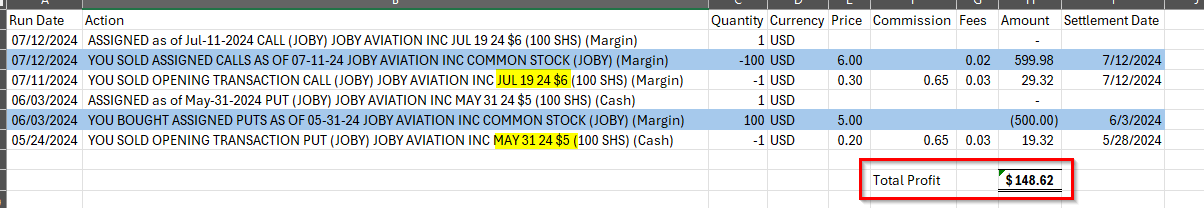

Final screenshot is a perfect example of how this works, and if it were always repeatable I’d be a billionaire.

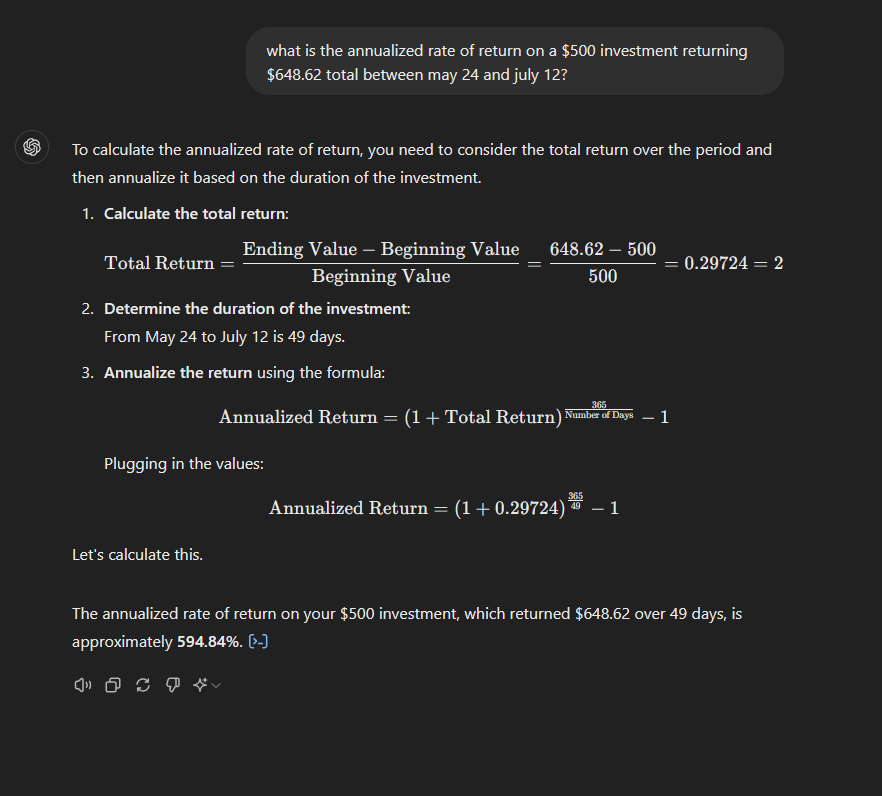

Sold a $5 strike for $20 (less commission), it filled. Sold a $30 covered call at $6 strike. Total profit is $100 (600-500 price difference) + 48.62 (premiums) = $148.62 for a $500 risk.

This is an annualized return of 594.84%, folks.